IRS announces 2017 pension plan limitations

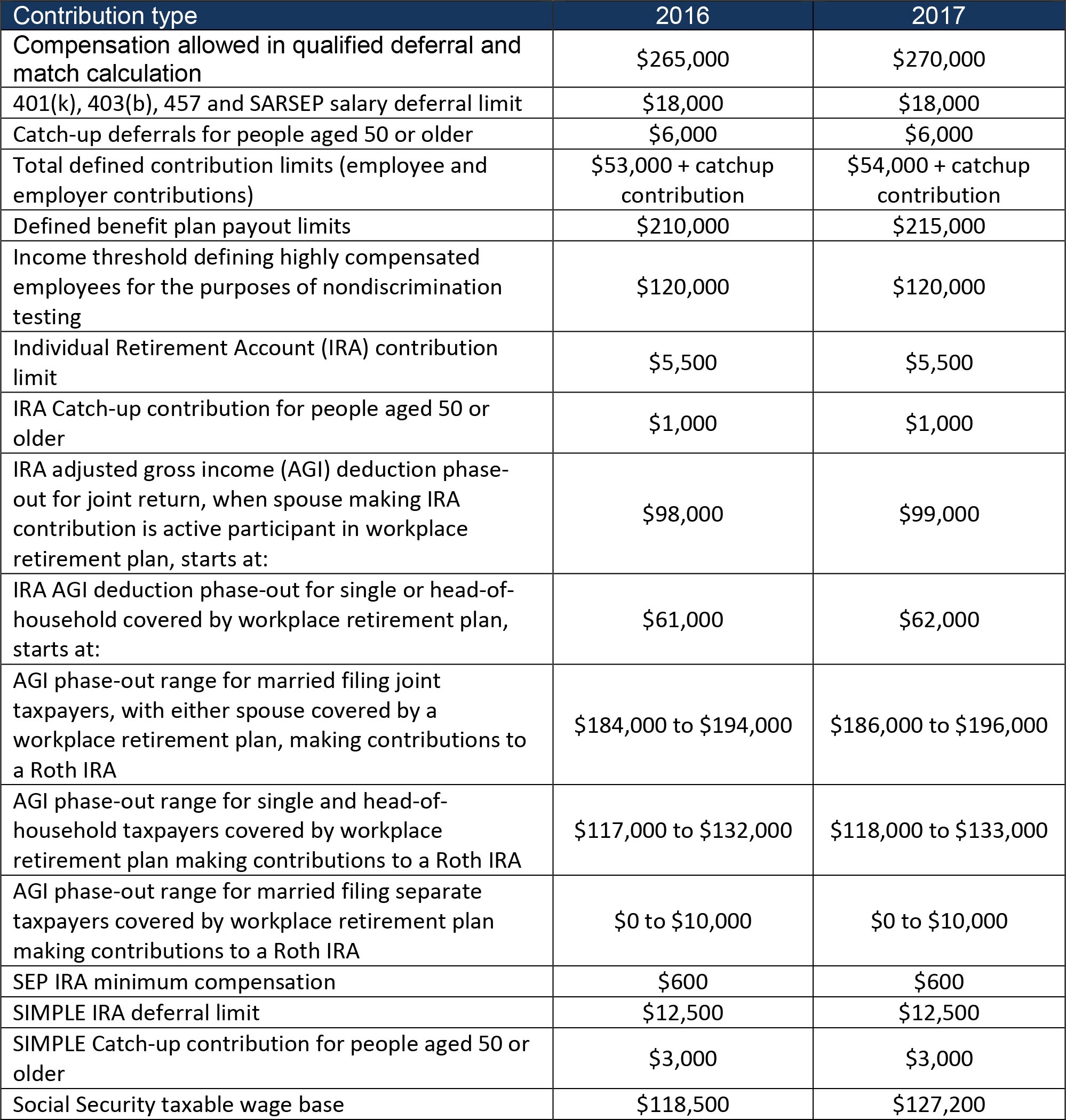

The Internal Revenue Service recently announced new pension and retirement plan limits for 2017. Many of the limits from 2016 are unchanged, but income phase-outs for IRA contributions, adjusted gross income limits, and the overall defined contribution plan limit show increases from 2016.

A few changes of note.

- For single taxpayers covered by a workplace retirement plan, the phase-out range is $62,000-$72,000, up from $61,000-$71,000 in 2016.

- For married couples filing jointly, where the spouse making the IRA contribution is covered by a workplace retirement plan, the phase-out range is $99,000-$119,000, up from $98,000-$118,000.

- For an IRA contributor not covered by a workplace retirement plan but married to someone who is covered, the phase-out range is $186,000-$196,000, up from $184,000-$194,000.

- For single and heads of household taxpayers contributing to a Roth IRA, the phase-out range is $118,000-$133,000, up from $117,000-$132,000.

- For married couples filing jointly contributing to Roth IRA, the phase-out range is $186,000-$196,000, up from $184,000-$194,000.

See the chart for a comparison of 2016 and 2017 limits and ranges. For any additional questions, be sure to contact your WK advisor at (573) 442-6171 or (573) 635-6196.